Start a Texas LLC

Starting an LLC in Texas is a great way to protect your assets while doing business in one of the most business-friendly states in the country. Below, we’ve created a step-by-step guide on how to register a Texas LLC.

If you’d rather delegate this chore, just hire us to form your LLC! Our Texas LLC formation package includes a year of registered agent service (just $35 a year) and a FREE business address you can use on your Texas Certificate of Formation, keeping your personal address out of online databases.

Texas LLC Formation

- $35/Year Registered Agent Service – No Price Hikes

- FREE Texas Business Address for Privacy

- Same-Day Mail Scans and Instant Notifications

- Attorney-Drafted LLC Operating Agreement

- Compliance Service Enrollment (no upfront cost)

- Free Domain for 1 Year (up to $25 value)

- Free Website + SSL, Email, & Phone Service for 90 Days

“I just had one of the best conversations EVER with Meagan H at Texan Registered Agent AGAIN. She is extremely knowledgeable of the product. Most remarkably, she had a lot of patience with me while maintaining HER SMILE the entire phone call. She assisted me with establishing my LLC, making what I was dreading a cinch. I am glad I had someone who enjoy helping others at my side. Thank you Meagan for THAT customer service that is nearly extinct!”

-Tx Hollah, 5-Star Google Review

Why Choose Us to Register Your Texas LLC?

What makes our Texas LLC service unbeatable?

- Texas Business Address

You get a FREE Texas business address you can use for all LLC members on your Certificate of Formation, protecting your privacy. - Establish Your Online Business Presence

We offer a full suite of online services you can try for FREE:- Free Domain for a Year

- Business Website*

- SSL Security*

- Business Email*

- Virtual Phone Service*

*Try free for 90 days, then $21.60/mo.

- Mail Forwarding Services

Unlimited free Secretary of State and legal mail scans, plus 3 free regular mail scans per year. You can upgrade to premium Mail Forwarding or get a full Virtual Office at checkout. - Legal Forms Library

Attorney-drafted Texas operating agreement, initial resolutions, state forms, and more. - Easily Keep Your LLC in Good Standing

With our Annual Compliance Service, we remind you before your Public Information Report/Franchise Tax Report deadline and then file for you. You pay nothing until your annual report is due. - Local Support

Our office is a short drive from the Texas capitol building, and our local employees are experts in handling Texas filings.

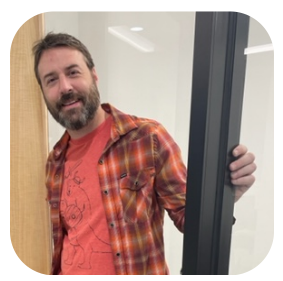

Jack and Maya at our Texan Registered Agent office.

Hire us and get the most affordable registered agent service in Texas—just $35/year.

How Much Does a Texas LLC Cost?

The state filing fee for the Texas Certificate of Formation is $300 (about $310 online). Our registered agent service is $35/year, and our LLC formation is a one-time fee of $100.

With Texan Registered Agent LLC, you save the most money year over year. Many of our clients started with Big Name registered agents but switched to us after they saw their bill double or triple after the first year.

Skip the Switch: We guarantee that your $35/year rate will never go up, saving you hundreds of dollars over time.

| Service | Fee |

|---|---|

| Texas State Filing Fee | $310 |

| Our LLC Formation Fee | $100 |

| One Year Registered Agent Service* | $35 |

| TOTAL | $445 |

How Does Our LLC Formation Service Work?

After you order our Texas LLC package:

- We list our Texas Business Address for every member of your LLC to protect your privacy.

- Our filers prepare and submit your Certificate of Formation.

- The SOS confirms your LLC.

- Your confirmation and custom business documents arrive.

- We provide a full year of Texas Registered Agent Service, including same-day scans of all your state and legal mail.

- We’ll send email reminders before your annual report due date and then file for you for $100 + state fees. If you prefer to handle Texas reports on your own, you can cancel this service in your online account.

- At the end of the year, your registered agent service renews for $35, and this rate will stay the same year after year.

How to Start an LLC in Texas

To start your LLC in Texas, you must appoint a Texas registered agent, file a Certificate of Formation with the Texas Secretary of State, and pay a $300 filing fee. We explain each step you need to take:

- Name Your LLC

- Appoint a Registered Agent

- Write Your Operating Agreement

- File Your Certificate of Formation

- Get an EIN

- Public Information Report

Rather leave it to the professionals? Hire us to form your LLC and get TX registered agent service for just $35/year.

Use our free online tool to complete your Certificate of Formation. Just download, print, and mail to the TX Secretary of State with the state filing fee, or save your progress and come back later.

1. Name Your LLC

Every Texas LLC needs a name. You should review the legal restrictions for Texas LLCs to be sure you do not violate state law. It is also worth taking the time to do a simple Texas business name search. This will tell you whether or not the name you are considering is already in use by another business.

According to Texas Business Organizations Code Sec. § Section 5.053, you cannot register a name that is too similar to the name of another Texas entity. This is one of the most common reasons new business filings are rejected by the Texas Secretary of State. If you want to hold a name before you file, you can file a Name Reservation, which is good for 120 days. Another important point to consider: if you’re a licensed professional, chances are you’ll have to form what’s known as a Professional LLC and include “PLLC” or “professional limited liability company” in your business name. (PLLCs are required for most people who work in medical or legal fields.)

Tip: To ensure the name reservation process does not cause any unnecessary delays when the time comes to form your LLC, make sure that the executioner of the name reservation (the person who submits and signs the form) is one of the managers of your LLC.

2. Appoint a Registered Agent

According to Texas law, every LLC must appoint a Texas registered agent on the Certificate of Formation. Your registered agent is the person or business entity responsible for accepting service of process on behalf of your company.

Your Texas registered agent must:

- Have a physical address (not a P.O. box) in Texas.

- Be present at that address during regular business hours to accept service of process.

- Be willing to have their address in a public database.

You can be your own registered agent if you live in Texas, keep regular business hours, and don’t mind your address being made public. Otherwise, consider hiring a registered agent service (like us!). When you hire us, you can use our Austin business address on your Certificate of Formation in all address fields, keeping your personal address private.

Our registered agent service is only $35 a year, every year. While many of our competitors offer a low starting price only to double or triple it at renewal time, we keep our price low so our customers feel good about renewing year after year.

3. Create Your Operating Agreement

An operating agreement—often referred to as a ‘company agreement’ in the State of Texas—is the governing document of your LLC. This legally binding agreement establishes the ownership, management, and procedures of your LLC, and all LLC members must agree to it.

It’s a good idea to create your operating agreement as early as possible, to avoid confusion or disputes later on. You may want to hire an attorney to review the agreement before it’s finalized. You do not need to file this document with anyone, but you should keep it with your business records.

With our LLC formation and Texas registered agent service, we include a free attorney-drafted LLC operating agreement, customized for your LLC structure.

4. File Your Certificate of Formation

The Texas Certificate of Formation is divided into sections called Articles. Each Article asks for specific information which is required for formation.

Articles

- Article 1: Entity Name and Type

List the name of your LLC here. - Article 2: Registered Agent and Registered Office

You must list the name and address of your Texas registered agent. The address must be a physical street address. It cannot be a PO box or a virtual address. - Article 3: Governing Authority

You must select whether your LLC will be managed by its members or by appointed managers. Regardless of which option you choose, you are required to list the names and addresses of all your initial governors (either members or managers). - Article 4: Purpose

Technically, you are not required to add anything to this section. It is already filled out with the basic state law, which is that your LLC is organized to conduct lawful purposes. However, there is space to include supplemental information should you want to more completely detail the business purpose of your LLC.

Execution

After the Articles, the final section of the Certificate of Formation is related to executing the formation. The information in this section is unique in that it cannot be amended later, whereas information in your Articles can be altered by filing an amendment.

Organizer

The organizer is simply the individual who has prepared and filed your Certificate of Formation. This does not have to be a member or employee of your LLC. For example, if you hired Texan Registered Agent to form your LLC, we would sign as your organizer.

Effectiveness of Filing

You must select one of three options for when the Certificate of Formation is to become “effective” (in other words, the time in which your LLC actually goes into existence).

- When the document is filed by the Secretary of State

- A later date, not to be more than 90 days after the date of signing

- A later date depended upon a specific event, not to be more than 90 days after signing

If you select the third option, you must supply the specific event or fact that will cause the Certificate of Formation to take effect. There is no limit on what event you can specify, but it must be specific. Once the event or fact has occurred, you must file a Statement of Event or Fact with the SOS.

For example, you may say that when your LLC has raised $10,000 of capital then the document will be effective. As long as the money is raised within 90 days, the Certificate of Formation will be executed. If the money is not raised within that time, then the formation does not occur.

Signature

The document must be signed and dated by the organizer.

Note that if you’ve already formed your LLC in another state and want to do business in Texas, you’ll need to register as a Texas Foreign LLC. (We can help with that, too!)

5. Get an EIN

Multi-member LLCs, all LLCs with employees, and LLCs taxed as corporations are required to obtain an Employer Identification Number. You can apply for an EIN at the IRS website. It is free to apply and the application is pretty straightforward. However, if none of the LLC members have a social security number, you will have to apply by mail, fax, or over the phone, and the process will take longer.

6. Submit Public Information Report

As of 2024, LLCs that make less than $2.47 million do not need to file a No Tax Due Report or pay the Texas Franchise Tax. However, they do need to file a Public Information Report with the Texas Comptroller by May 15 each year.

You can submit this form online via eSystems or by mail to:

Texas Comptroller of Public Accounts

P.O. Box 149348

Austin, TX 78714

Texas LLC FAQs

What are the benefits of forming an LLC in Texas?

There are several ways forming an LLC can benefit your business:

- Liability Protection. LLC stands for “limited liability company,” and one of the main benefits of LLCs is how they can protect their members from personal liability. LLCs are legally separate from their members, so if the LLC is sued or goes into debt, members are usually not held personally liable and their individual assets are protected.

- Flexibility. LLCs have fewer requirements than corporations. For example, LLCs don’t need to have a board of directors or hold annual meetings. Instead, most of the specifics of how your LLC is managed can be decided by you in your LLC operating agreement.

- Tax Options. LLCs are taxed as “pass-through entities” by default, which means they don’t have to pay corporate income tax. Instead, the profits and losses “pass through” the business to the members, who report them on their individual tax returns. An LLC can also opt to be taxed as an S-corporation or C-corporation.

What is a Texas DBA?

A Texas DBA (also called an assumed name) is a name used by a business that isn’t the business’s legal name. Your LLC’s legal name will be the name you put on the Certificate of Formation. If you decide you want to use a different business name, you’ll need to register the name as a DBA.

LLCs that want to register a DBA must file an Assumed Name Certificate with the Texas Secretary of State ($25). The certificate needs to be renewed every 10 years. In most counties, LLCs only need to register their DBA at the state level, not the county level. However, in a few places, such as Tarrant County, assumed names must be filed at both the state and the county level.

How do I maintain an LLC in Texas?

Once you start your LLC, there are a few steps to take to maintain your LLC over time:

- Open a business bank account. In order to keep your LLC finances separate from personal finances, it’s important to open a business bank account right away. Contact your bank to see what information they require.

- File the Public Information Report. Unless your LLC makes over $2.47 million a year, you won’t need to pay Texas franchise tax. But you still need to submit an annual Public Information Report with the Texas Comptroller. The due date is May 15.

- Amend Your Certificate of Formation when required. If any of the information on your Certificate of Formation changes, such as your business name or registered agent, you’ll need to file a Certificate of Correction with the Secretary of State. All LLC members must approve the change.